Last week, the price of Ethereum once again sank below the $2000 mark. Readings from key on-chain metrics report that crypto whales have started buying ETH in the hope of a new rally.

On July 19, an unknown whale moved 61,000 ETH worth about $120 million to the Kraken crypto exchange. To reduce the impending selling pressure to nothing, other large investors began to actively buy coins. Let's figure out whether their efforts will be enough to prevent a possible fall in the price of Ethereum.

Ethereum bulls are trying to resist selling pressure

According to the analytical platform Santiment, in the period from July 15 to July 20, addresses with a balance of 100,000 to 1 million Ethereum bought another 150,000 coins.

Given that the price of the asset is currently hovering around $1900, the value of the purchased tokens is more than double the potential pressure to sell 61,000 ETH from the mysterious whale's wallet.

Given the financial power of large investors, the asset has every chance of a rebound - even if, as a result of the sale, its price temporarily decreases even more.

ETH investors are hoping for a new rally

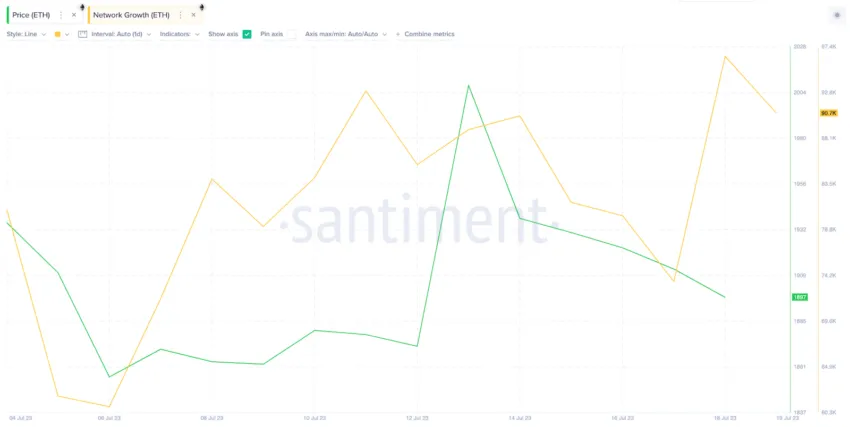

Between July 5 and July 20, the number of daily new addresses registered on the Ethereum network soared by 49%, from 60,923 to 90,173. The sharp increase in the number of users suggests that retail investors are also actively preparing for a new rally.

The surge in interest in ETH and whale buying are two critical indicators that the price of the asset is likely to hold at $1800.

Ethereum price may bounce back to $2000

The factors listed above indicate that the price of ETH is likely to break above $2000 again. However, a further rally may be hindered by 683,000 addresses that purchased 27.3 million coins at an average price of $2020. If the asset manages to overcome this resistance, Ethereum will continue to rise in the direction of $2100.

In case of falling below the support level of $1800, the initiative will go to the bears. 3.44 million wallets that bought 4.5 million ETH at an average price of $1860 may provide it with some support, but in case of failure, the second largest cryptocurrency by capitalization will decline to $1780.