This week, the price of the native token of the L2 blockchain Polygon soared by 16%. One of the main reasons for the growth was the launch of an artificial intelligence (AI) chatbot based on ChatGPT called Copilot, which brought new users to the network. However, the readings of key on-chain metrics also give numerous green signals, hinting at the upcoming recovery of MATIC quotes. Let's figure out whether the bulls will be able to win back the $1 milestone.

Polygon attracts more and more new users

Despite the recent 35% collapse in the price of MATIC, Polygon continues to attract new users. The Santiment chart below shows that the daily increase in addresses has consistently remained above 60,000, and on June 4, the blockchain registered 81,741 wallets.

The Network Growth metric measures the rate of acquisition of new users by summing up the daily number of addresses created. When it remains relatively high during a large-scale price drop, it indicates the high value of the network and confirms that products and services built on top of Polygon are in demand.

If the Copilot chatbot is widely accepted, the blockchain will be able to get even more users, which will contribute to the recovery of the MATIC price to $1.

Crypto whales are buying MATIC again

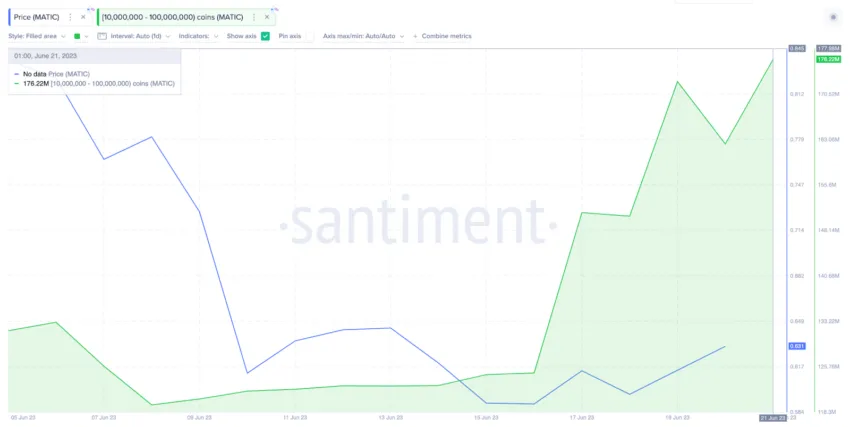

Another positive sign is the actions of whales. The graph below shows that between June 15 and June 22, addresses with a balance of 10 million to 100 million MATIC added another 52 million coins worth about $36.4 million to their holdings

The activity of large investors is the most important factor that can contribute to the further growth of the MATIC price.

Polygon price may return to $1

The above-mentioned factors indicate that MATIC may test $1 again in the coming weeks. However, the IOMAP metric of the IntoTheBlock platform reports that on the way to this mark, the asset will be pushed with significant resistance from 8250 addresses. They bought 630 million tokens at an average price of $0.77 and will probably want to take profits.

The IOMAP map shows the most significant clusters of positions in the range of +-15% of the current price. Its analysis quantifies positioning that can be used as a complement to traditional support/resistance patterns.

In the event of a fall below $0.65, control will pass to the bears. A wall of 6,260 wallets with a total balance of 81.84 million coins could prevent a decline. However, if they fail to do so, Polygon will continue to dive towards $0.60.