The U.S. Securities and Exchange Commission (SEC) has given the green light to Volatility Shares' 2x Bitcoin Strategy ETF (BITX), the first leveraged cryptocurrency ETF in the U.S.

Leveraged exchange-traded funds (ETFs) use futures markets to increase the returns on the index they use. Although these products occupy only a small part of the ETF segment, their popularity is growing rapidly due to the possibility of obtaining higher returns in a short period of time while maintaining a positive price trend.

The BITX ETF offers customers the opportunity to gain exposure to Bitcoin (BTC) by staking only half of its value. The alignment of the ETF with the CME Bitcoin Futures Daily Roll index adds confidence in its financial mechanics. Stuart Barton, CEO of Volatility Shares, emphasized the attractiveness of integrating digital assets into the structure of exchange-traded funds.

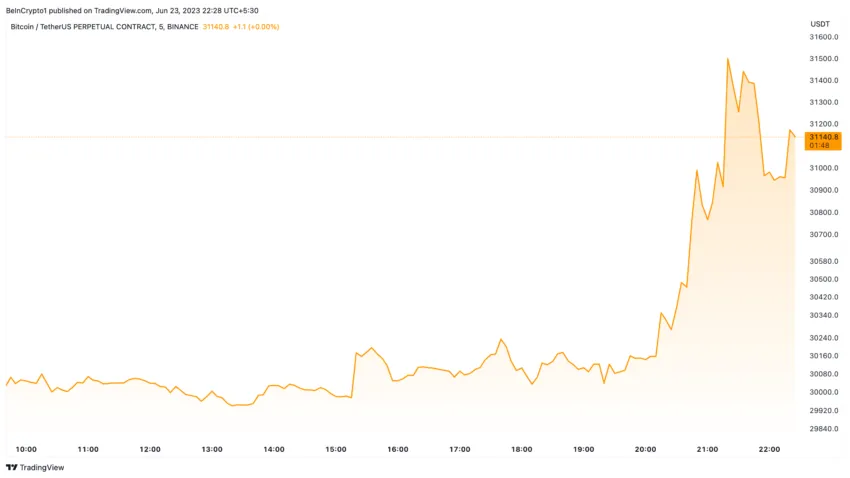

Bitcoin soars to $31,000

Against the backdrop of the approval of Volatility Shares' 2x Bitcoin Strategy ETF, the price of the oldest cryptocurrency exceeded $31,000. The growth was also spurred by positive news about applications for spot bitcoin ETFs filed blarge investment companies such as BlackRock.

y

y The launch of the BITX ETF is definitely a breakthrough, signaling a significant change in the SEC's stance on crypto-related offerings. It strengthens the strength and legitimacy of bitcoin futures as an asset class.