The total amount of liquidations in the crypto market over the past 24 hours exceeded $140 million. Most of the liquidations - $87 million, fell on short positions, as a sharp rise in the price of bitcoin (BTC) crossed out traders' expectations of a further decline in the price of the main cryptocurrency amid pressure from regulators

According to Coinglass, bitcoin became the leader in terms of liquidation — traders lost about $55.89 million on it, the largest order of $3 million was executed by the Binance crypto exchange. ETH, BCH, PEPE and LTC holders also suffered significant losses. Those who opened long positions in SOL, XRP, CFX and DOGE were also unlucky.

Market participants remain bullish on BTC

Over the past week, the cryptocurrency market has witnessed a new wave of institutional interest in BTC. Several traditional financial institutions, including investment giant BlackRock, have applied to launch a spot bitcoin ETF. In addition, on June 20, the EDX crypto exchange launched by Fidelity and Citadel began operating.

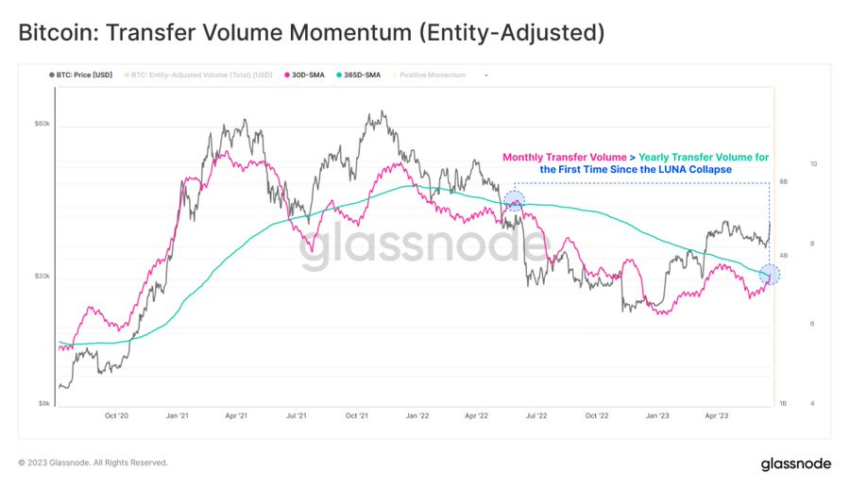

The rise in positive market sentiment has caused the monthly volume of BTC transfers to exceed the annual average for the first time since the collapse of the Terra ecosystem. Glassnode analysts noted that this indicates an increase in on-chain activity, which is characteristic of improving the fundamental indicators of the network.