Bitcoin (BTC) has become the best-performing asset of the first half of 2023, with the price of the main cryptocurrency rising by more than 80% since the beginning of January.

In the first half of the year, the cryptocurrency market overcame the consequences of the collapse of FTX and the bankruptcies of a number of large companies related to digital assets. During this period, the industry also witnessed a renewed institutional demand for BTC and the emergence of "ordinals" on the Bitcoin network.

Against the backdrop of these events, the price of BTC soared from $16,000 to $31,000, significantly outpacing other significant assets such as gold and the Nasdaq, S&P 500 and Nikkei 225 stock indices.

BTC is experiencing a surge in institutional interest

On June 15, investment giant BlackRock, which manages about $10 trillion, applied to create a spot bitcoin ETF. Major players such as Fidelity, Valkyrie, WisdomTree, Invesco and others did the same.

At the end of last week, the WSJ reported that the US Securities and Exchange Commission (SEC) called ETF applications "inadequate." However, the companies immediately responded to the regulator's concerns and made the necessary changes to them. This has sparked speculation in the community that the first spot ETF in the U.S. could be approved as early as the near future.

The Ordinals protocol has expanded the functionality of the Bitcoin network

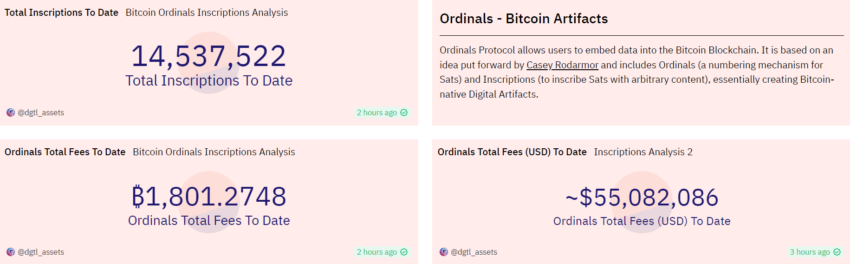

The Ordinals protocol is a numbering system that assigns each Satoshi a unique serial number (ordinal) and tracks its movements during transactions. Thus, the protocol allows you to make each Satoshi unique by attaching additional data to it, which adds an "inscription"

.The growing interest of users in Ordinals has led to the fact that the number of daily transactions in the Bitcoin network has updated a new historical maximum. And although some maximalists condemn the creators of the protocol and believe that the blockchain should be limited only to the functions of storing and transferring funds, Ordinals brought innovation to the cryptocurrency space and drew attention to the flagship digital asset.

According to Dune Analytics, the total number of residents today is more than 14 million, and the amount of commissions received for their creation is about $ 55 million.

The actions of regulators force users to turn to BTC

Against the backdrop of these positive developments, regulators in the United States have increased pressure on the crypto industry. The SEC and CFTC accused cryptocurrency exchanges Binance and Coinbase of violating federal securities laws and included a number of altcoins among them, including MATIC, SOL and ADA.

However, the repression of regulators played into the hands of bitcoin. Since the SEC and the CFTC agreed that BTC belongs to the category of goods, investors began to actively redistribute capital, preferring the main cryptocurrency to risky altcoins.