The rating of losers was headed by the Apecoin token, which updated its historical low this week. In addition to APE, the list includes:

Apecoin (APE) -22,64%

Fantom (FTM) -13,89%

Conflux (CFX) -12,21%

Synthetic (SNX) -11,50%

Stellar (XLM) -10,88%

APE topped the ranking of loser altcoins

ApeCoin is the native token of Yuga Labs' Ape ecosystem, which includes one of the most popular NFT collections, the Bored Ape Yacht Club. On July 17, the project will hold a major token unlock.

Values above 50 and an uptrend indicate that the bulls maintain an advantage, and vice versa. In this case, a value below 50 and a fall in the indicator is a sign of a bearish trend.

If the APE continues to decline, the next immediate support will come into play at $1.59. However, if the price starts a rally, it may move towards the line of short-term downward resistance, which is now passing at $2.50.

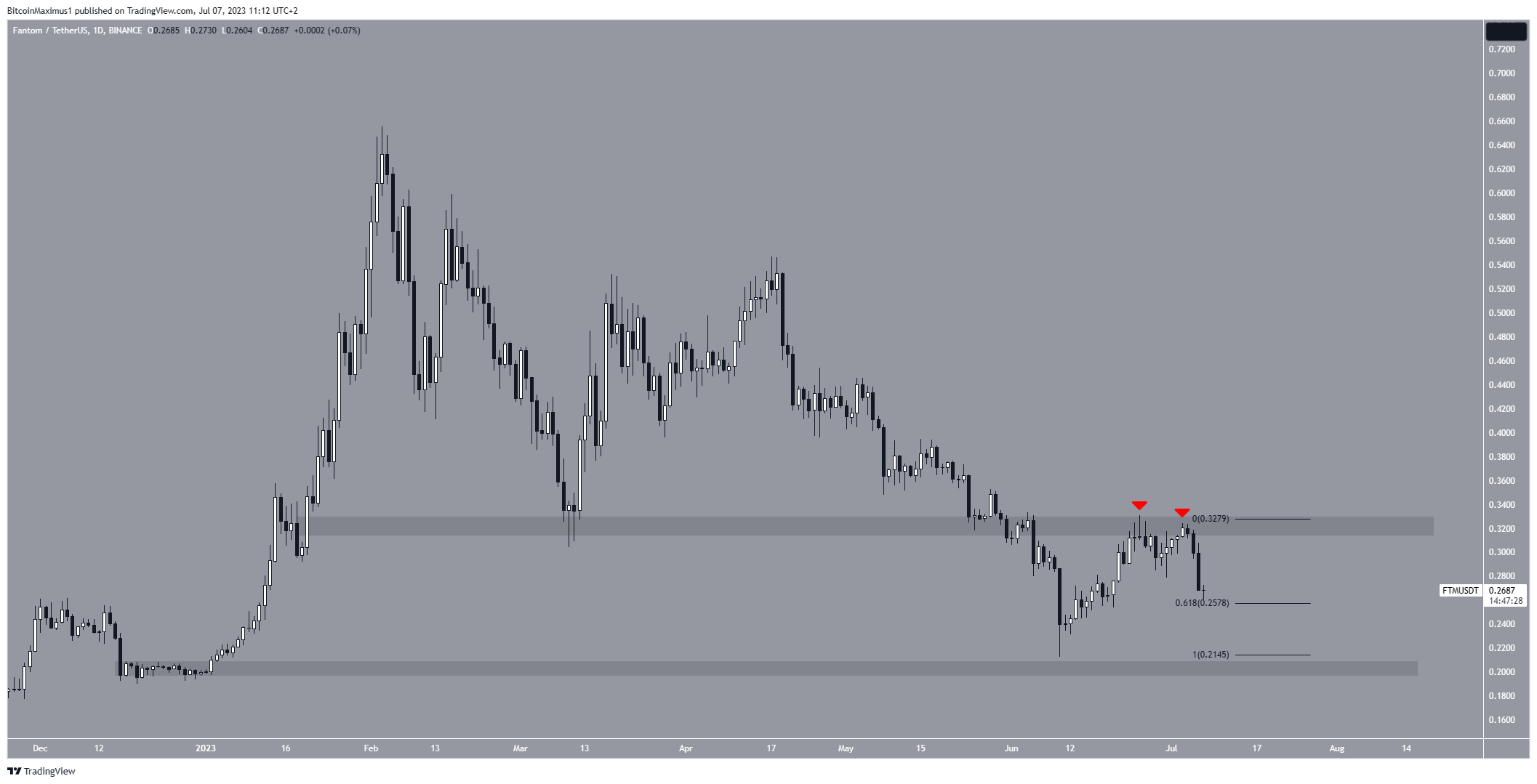

Fantom (FTM) falls after rebounding

The price of FTM, the token of the Fantom project, began its upward movement on June 10. In the process of growth, it made two attempts to break through the resistance area of $0.32. However, both of them were unsuccessful, forming successive decreasing highs (red icons). After the second high, the price of FTM fell sharply.

FTM is trading just above the 0.618 Fibo support retracement at $0.26. Fibonacci levels are traditionally considered the most likely springboards for stopping and reversing the price after significant progress in any one direction. As expected, at these levels, the market can win back part of the distance traveled and only after that resume movement in the original direction. In addition, they can determine the limit levels of the price movement.

Conflux (CFX) price failed to overcome resistance

Conflux is a layer-one blockchain created as a competitor to Ethereum with active government support from China. Earlier this year, the project partnered with state-owned telecom heavyweight China Telecom to develop and issue blockchain-enabled SIM cards

. CFX has been declining inside the downstream parallel channel since March 13. This pattern is considered corrective, so its southward orientation suggests that the broader trend in the currency is bullish and eventually the price will make a breakout to the north from this channel.

On June 10, the CFX price bounced off the channel's support line and started an upward movement in the direction of resistance. However, it bounced off the midline of the channel (red circle) and has been declining ever since. This is considered a bearish sign.

If the decline continues, CFX may fall to the $0.14 support level formed by the channel's support line and the $0.14 horizontal support area. On the other hand, if the CFX breaks above the midline of the channel, then the most likely scenario would be for the token to rise towards the resistance line.

Synthetix (SNX) wins a key horizontal layer

The price of SNX has been rising since June 10 and eventually recovered above the important horizontal area of $2. Previously, it seemed that the token had made a bearish breakout of this level. However, the rise in price proved that the previous breakout was only a deviation.

If the rise continues, SNX could move towards the long-term downward resistance line at $2.50. However, if the price closes below the $2 area, a fall to a yearly low of $1.30 is likely.

Stellar (XLM) closes the list of outsider altcoins of the week

Closes the list of loser altcoins Stellar. On June 30, the price reached a new one-year high of $0.12. However, despite the growth, it failed to make a clean breakout and close above the $0.11 resistance area. Instead, it has formed a long top wick (red icon), which is considered a sign of pressure from sellers.

After that, the token has been declining at an accelerated pace and is currently approaching the $0.09 support area.

If XLM makes a rebound, it may try to break above $0.11. However, in case of a bearish breakout, we can expect a decline to the next support at $0.08.