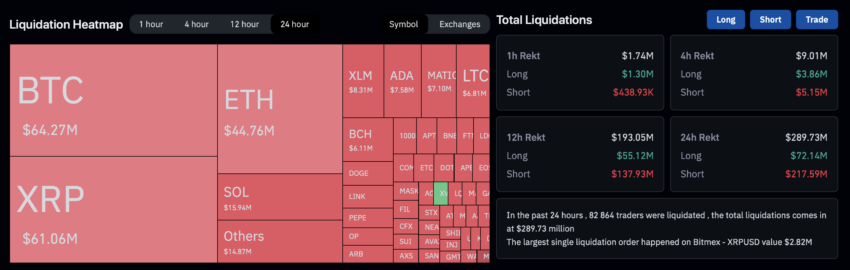

The total amount of liquidations in the crypto market over the past 24 hours has reached $290 million, with XRP and BTC accounting for most of the closed positions.

The explosive growth of the price of the native token of the Ripple project and the update of bitcoin to the next annual high at around $31,840 cost traders $61.06 million and $64.25 million, respectively. Market participants who opened short positions on ETH also suffered significant losses.

80% of forced closures were split between OKX, Binance, and Bybit. The largest order was executed by Bitmex — the exchange liquidated XRPUSD shorts in the amount of $2.82 million.

XRP took BNB's place in the top 5 cryptocurrencies

Against the backdrop of Ripple's victory in the lawsuit with the SEC, which has dragged on since 2020, the crypto market was overwhelmed by a wave of positivity. Recall that yesterday the court recognized that XRP that was sold to retail investors cannot be qualified as securities. However, institutional sales of an asset still fall under this definition.

After the decision was made, the price of the token soared by tens of percent, provoking a rally among other altcoins. The impressive growth led to the fact that XRP rose to 4th place in the CoinGecko ranking, overtaking BNB in terms of capitalization.

At the time of writing, Ripple is trading at $0.79, the highest since April 2022. Still, that's still 76% below 2018's all-time high of $3.40 — even with yesterday's monumental jump.