Coinbase and Binance ceded part of the market share to the Kraken and Bitstamp exchanges after the US Securities and Exchange Commission (SEC) filed a lawsuit against Coinbase

The volume of cryptocurrency trading in the United States on the Kraken platform rose to 29%, and at Bitstamp, another international exchange with a presence in the United States, the share of American volumes increased to 9%.

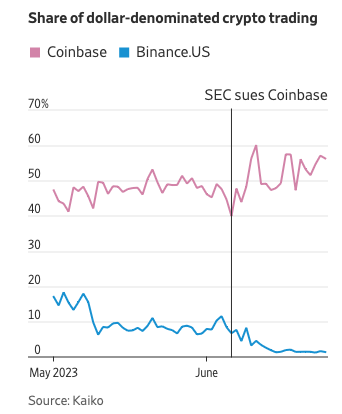

Litigation with the SEC hit the positions of Coinbase and Binance in the market

In early June, the US Securities and Exchange Commission (SEC) filed a lawsuit against crypto exchange Binance, and a day later against its main competitor Coinbase in connection with the offer of unregistered securities and violation of business requirements in the country.

As a result of these harsh repressive measures, Coinbase's share of cryptocurrency trading volume in the United States decreased from 62% in January to 51% as of June 18. The market share of Binance.US, the U.S. division of crypto market heavyweight Binance, has declined to around 1.15% since Ma

Wade Gunther, a partner at the investment company Wilshire Phoenix, believes that exchanges differ from each other in the breadth of token offerings. Now Kraken and Bitstamp, competitors of the affected trading platforms, hope to take advantage of the current situation. However, we must not forget that they are also potentially at risk of applying similar regulatory measures after the SEC updated the list of cryptocurrencies classified as securities.

Exchanges' retaliatory claims against SEC rejected

In response to the actions of the regulator, Coinbase also filed a motion to terminate the trial. The company argues that the SEC cannot expand the powers granted to it by Congress in 1933 under the Securities Act. In fact, Coinbase said the courts should reject the SEC's attempts to expand its sphere of influence beyond the law, which allows the regulator to apply civil penalties but not revise securities laws to regulate cryptocurrencies.

However, the SEC opposed Coinbase's motion to dismiss the charges against the exchange. A preliminary hearing in the case will be held this Thursday. A similar fate befell Binance's counterclaim against the SEC for libel. He, too, was rejected.

In addition to the SEC, the U.S. Commodity Futures Trading Commission has also accused Binance of providing U.S. companies with illegal access to crypto derivatives trading. Meanwhile, such companies could provide the exchange with the liquidity necessary for the smooth conduct of business.