The price of Litecoin increased by 5% and again reached the $100 mark. However, historical data suggests that as the halving approaches, the price of LTC is likely to decline.

Three weeks before the first-ever Litecoin halving in 2015, the price of the asset reached a high of $7.54 on July 10, and then fell by 42% to $4.40. A similar pattern was observed in 2019. On June 23, LTC quotes soared to $142 and fell by 53% to $93, by the halving date. The downtrend continued for several more months, after which the coin began a new rally in January 2020.

Miners get rid of Litecoin

After buying 300,000 coins in June, miners began to get rid of their Litecoin holdings. Data from IntoTheBlock shows that they sold about 90,000 tokens between July 5 and July 11.

The Miner Reserves metric tracks changes in the balances of miners' wallets and mining pools in real time. In the chart below, you can see that they have taken a bearish stance despite the recent price spike.

Historical data for 2015 and 2019 show that LTC quotes fell twice immediately after the halving. Therefore, many miners are trying to unload part of the reserves as an important date approaches.

Traders are opening more and more orders to sell LTC

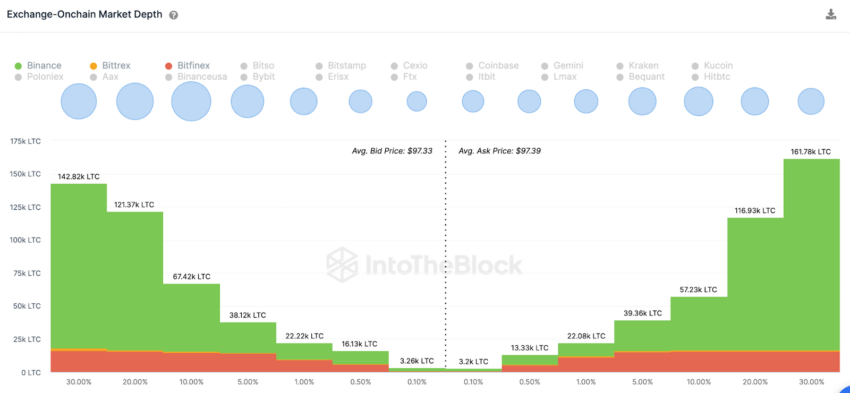

The market depth chart of the IntoTheBlock platform confirms the bearish outlook. According to its data, traders placed limit orders to sell 414,000 and buy 411,000 LTC.

Thus, the supply of Litecoin on exchanges exceeds the demand for more than 3000 coins.

If the bearish momentum builds up on the eve of the halving, the price of the asset may face a serious correction.

The price of Litecoin may drop to $80

Given the historical trends and bearish factors described above, LTC is likely to see a correction to $80 in the coming weeks. However, 1.26 million addresses that purchased 11.8 million coins at an average price of $88.42 may provide some support to the asset. If the selling pressure, as expected, increases, Litecoin quotes may drop sharply below the $80 mark.

In case of consolidation above $100, the initiative will go to the bulls. However, a cluster of 572,000 wallets that bought 3.63 million LTC at a minimum price of $100.95 could exit positions at the break-even point and slow down further growth.